Want to buy a house in Belgium? It’s a great idea for locals, immigrants, and even non-residents, as the market is stable, and housing in Brussels offers a chance for residency or investment! This article breaks down how to find and buy property, and what locals and foreigners need to know. From house hunting to signing contracts — all steps explained simply, plus tips on saving on taxes and avoiding pitfalls!

Overview of the Belgian Property Market

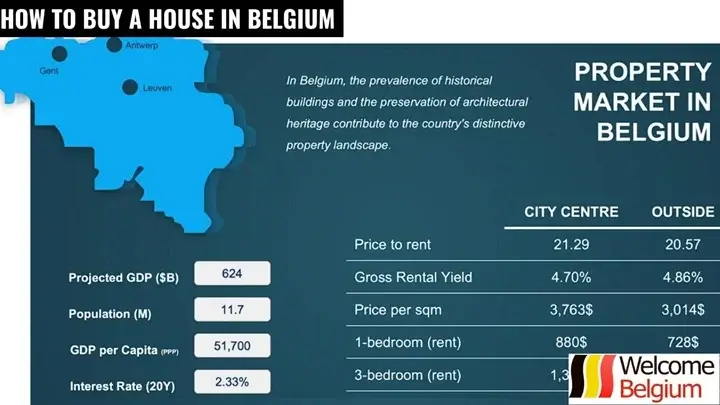

The Belgian property market remains attractive for locals, immigrants, and non-residents due to steady price growth and high demand. In 2024, the housing price index rose by 2.9% compared to the previous year, making buying a house in Belgium a solid investment.

The average cost per square meter varies significantly by region:

- Brussels: €3,000–€5,000 per m², high demand for apartments and townhouses.

- Flanders: €2,000–€3,500 per m², popular for modern houses and apartments, especially in Antwerp.

- Wallonia: €1,300–€2,500 per m², affordable detached houses and villas, e.g., in Hainaut (€1,373 per m²).

Popular property types include:

- Townhouses in Flanders (from €245,000 for 200 m²).

- Apartments in Brussels (from €295,000 for 105 m²), ideal for expats.

- Villas in Wallonia (e.g., €1.38 million for 815 m² in Vliermaal).

Renting out a house yields 3–5% annually in Brussels, attracting investors. The economy, low mortgage rates (3–4% in 2025), and migration drive demand, especially for housing in Brussels. Locals benefit from tax incentives, such as a reduced transfer tax (6% instead of 12.5%) for first homes. Foreigners, including immigrants and non-residents, can buy property without restrictions but must declare rental or commercial property income.

Buying property in Belgium often involves renovations, where an architect comes in handy. They assess the house’s condition, propose renovation plans, and ensure compliance with local standards, like EPC energy efficiency. This is especially important for foreigners unfamiliar with Belgian regulations. Find an architect via Ordre des Architectes (www.ordredesarchitectes.be), with service costs at 5–10% of the renovation budget.

Tip:

Investing in property in Wallonia can be more profitable for foreigners due to lower prices and high rental demand.

Steps to Buying a House Independently

Buying property in Belgium is a straightforward process, identical for locals, immigrants, and non-residents, but it requires attention to detail. Whether you’re searching for a house in Belgium via online platforms or bidding at auctions, knowing the steps helps avoid mistakes and save time.

Here are the main steps to owning a home:

- Property Search: Start by exploring the market via sites like Immoweb or Zimmo, or hire a real estate agent for tailored options. Online searches are popular for convenience, while auctions (public or notarial) offer homes at lower prices but require quick decisions.

- Negotiations and Offer: After choosing a house, make an offer to the seller, often through an agent. Bargaining is common in Belgium, especially in Wallonia, where prices are lower.

- Signing the Preliminary Contract (Compromis): This document locks in the deal’s terms, including price and timeline. A deposit (5–10% of the price) is typically paid to the notary’s account.

- Inspection and Financing: Within 2–4 months after the compromis, the house is appraised, and a mortgage is arranged if needed. This stage is shorter for auctions.

- Notarial Formalities: The notary verifies purchase documents, prepares the final deed of sale, and registers the deal. This is a mandatory step for legality.

- Final Property Registration: After signing the deed and paying taxes (6–12.5%), you receive the keys, and the house is registered in your name in the cadastre.

The process takes 3–6 months, depending on the deal’s complexity and purchase method. Online searches simplify selection, but working with a real estate agent and notary ensures your interests are protected. For auctions, inspect the property beforehand, as withdrawing after winning is difficult. Thorough preparation of purchase documents and understanding the preliminary contract obligations make buying a house in Belgium smooth and successful.

Buying property in Belgium may involve renovations or construction, requiring a building permit (permis d’urbanisme). Issued by the local commune, this document ensures compliance with building codes and zoning, crucial for old houses or commercial properties. Foreigners and immigrants should hire an architect or real estate agent to apply (cost €100–500) to avoid fines for unauthorized work. Check requirements on the commune’s website or through Flanders Environment Agency for Flanders.

Costs of Buying a House in Belgium

Based on 2025 data, the costs of buying a house in Belgium average 11–22% of the property price (lower for older homes, higher for new builds due to VAT). Costs vary by region (Flanders, Wallonia, Brussels), mainly due to transfer tax rates (registration duties). Below is a detailed breakdown of expenses, accounting for primary residence incentives. Percentages are based on the purchase price unless stated otherwise. Fixed amounts are in euros. These are estimates; consult a notary for precise calculations.

| Expense Type | Flanders | Wallonia | Brussels | Notes / Additional Info |

| Transfer Tax (Registration Duties) for older homes (>2 years) | 2% for primary residence (2025; if price < €220,000 — extra €1,867 discount); 12% for others or investments. | 3% for primary residence (2025); 12.5% for others. | 12.5% base rate; exemption on first €200,000 (up to €25,000 discount) for primary residence if price < €600,000; extra €25,000 per energy efficiency upgrade (minimum 2 classes in 5 years). | Calculated on price or market value (higher). Same rates for foreigners/non-residents, but rental income must be declared. No purchase restrictions. |

| VAT for new builds (<2 years) | 21% on building; land under registration duties (2% or 12%). 6–12% for social housing. | 21% on building; land under registration duties (3% or 12.5%). 6–12% for social housing. | 21% on building; land under registration duties (12.5% with exemptions). 6–12% for social housing. | Replaces registration duties on building. VAT deductible for commercial properties. |

| Notary Fees | 0.2–4% (average 1.6%) + fixed €813 for deed + €596–813 for mortgage. | 0.2–4% (average 1.6%) + fixed €813 for deed + €596–813 for mortgage. | 0.2–4% (average 1.6%) + fixed €813 for deed + €596–813 for mortgage. | Sliding scale; split if two notaries. Includes administrative costs (searches, documents). Calculator: notaire.be. |

| Estate Agent Fees | Usually paid by seller (3–5%); if buyer hires — €200–1,000. | Usually paid by seller (3–5%); if buyer hires — €200–1,000. | Usually paid by seller (3–5%); if buyer hires — €200–1,000. | Recommended for non-residents due to language/market barriers. |

| Valuation Costs | €200 + VAT (21%). | €200 + VAT (21%). | €200 + VAT (21%). | Required for mortgages; statistical or on-site. |

| Mortgage Costs | Setup fees up to €350; 1% for mortgage registration; 0.3% for subscription; + notary. | Setup fees up to €350; 1% for mortgage registration; 0.3% for subscription; + notary. | Setup fees up to €350; 1% for mortgage registration; 0.3% for subscription; + notary. | Mortgage rates ~3–4% in 2025. Non-residents need extra income documents. |

| Insurance | Building insurance (mandatory for mortgages, ~€200–500/year); loan balance insurance (by age/amount, ~0.5–1% of loan). | Building insurance (mandatory for mortgages, ~€200–500/year); loan balance insurance (by age/amount, ~0.5–1% of loan). | Building insurance (mandatory for mortgages, ~€200–500/year); loan balance insurance (by age/amount, ~0.5–1% of loan). | Optional household insurance ~€100–200/year. |

| Other Expenses | Document fees, annex fees, urbanism requests (~€100–300); proportional property tax (if seller paid). Annual tax 1.25–2.5% of cadastral value. | Document fees, annex fees, urbanism requests (~€100–300); proportional property tax (if seller paid). Annual tax 1.25–2.5% of cadastral value. | Document fees, annex fees, urbanism requests (~€100–300); proportional property tax (if seller paid). Annual tax 1.25–2.5% of cadastral value. | For renovations: architect (percentage of work), permits (~hundreds of euros). For immigrants — linked to residency. |

| Total Costs (% of price) | 11–16% for older homes; up to 22% for new builds. | 11–16% for older homes; up to 22% for new builds. | 11–16% for older homes; up to 22% for new builds. | Depends on incentives; same for non-residents, but mortgages are harder. |

Use calculators on notaire.be or consult a notary for precise costs tailored to your deal.

Differences for Locals, Immigrants, and Non-Residents

Buying property in Belgium is open to all — locals, immigrants, and non-residents — but each group faces unique aspects. Understanding these differences helps minimize investment risks and choose the best path to owning a house in Belgium.

Locals

For Belgians, buying a house in Belgium is streamlined due to tax incentives and easy financing. In 2025, Flanders offers a 2% transfer tax for primary residences (with an extra €1,867 discount for homes under €220,000), Wallonia — 3%, and Brussels — exemption on the first €200,000 for homes under €600,000. Locals also get easy mortgage access (3–4% rates) with minimal document requirements, as banks like BNP or ING already have their credit history, making the process fast and cost-effective, especially for first homes.

Immigrants (with residency)

For immigrants with a residence permit, buying property opens additional opportunities. Owning a home doesn’t grant automatic residency but strengthens applications for status renewal or citizenship through naturalization (typically after 5 years). Immigrants have the same purchase rights as locals and can claim tax incentives if the home is their primary residence. However, banks may require proof of stable Belgian income, and mortgages can be complicated due to limited credit history. A real estate agent helps navigate language barriers and speeds up the process.

Non-Residents (foreigners without residency)

Non-residents can freely buy property without legal restrictions, making Belgium attractive for foreign investors. However, they face extra checks for mortgages: banks require proof of income (local or foreign), tax returns, and sometimes notarized document translations. Tax incentives available to locals and immigrants (e.g., reduced transfer tax) may not apply if the home isn’t a primary residence, raising transfer tax costs (up to 12.5% in Brussels and Wallonia, 12% in Flanders). Investment risks for non-residents include currency fluctuations and the need to declare rental income in Belgium. Consulting a local notary or real estate agent minimizes these challenges.

Buying a house in Belgium is a viable option for both living and investing, with locals benefiting from incentives and easy financing, immigrants gaining residency prospects, and non-residents needing to prepare for extra documents and costs.

Financing and Mortgage

Financing property purchases in Belgium is crucial, especially for foreigners and non-residents, where investment risks are higher due to additional checks. Most buyers opt for a mortgage, but self-financing is also possible for those with sufficient funds. This section covers options, conditions, and differences by category.

Mortgages in Belgium are available through banks like BNP Paribas or ING, with fixed rates around 3–3.5% in 2025, depending on the term (10–30 years) and credit history. Conditions include a 10–30% down payment, with higher requirements for riskier borrowers. The process starts with pre-approval to include in the preliminary contract (compromis). A real estate agent can recommend suitable banks.

Self-financing suits those avoiding debt and interest: you pay the full amount in cash or transfer, simplifying the deal and reducing investment risks, but it requires liquid assets. This is popular among non-residents with foreign assets, though purchase documents are still needed for the notary.

Differences depend on status: locals get mortgages easily due to local credit history and incentives; immigrants with residency need proof of Belgian income; non-residents face stricter checks (income proof, tax returns) and potential loan denials without local presence.

| Category | Down Payment | Mortgage Rates (2025) | Required Documents | Investment Risks |

| Locals | 10–20% | 3–3.2%, easy access | Passport, income, credit history | Low, due to incentives |

| Immigrants (with residency) | 15–25% | 3.1–3.4%, with checks | Residency permit, Belgian income, passport | Medium, language barriers |

| Non-Residents (foreigners) | 20–30% | 3.2–3.5%, strict checks | Foreign income, translated documents, tax returns | High, currency risks, denials |

List of Banks Offering Mortgages in Belgium

Below are the main banks, their websites, head office addresses, and mortgage conditions for 2025. All banks work with locals, immigrants, and non-residents, but requirements for foreigners are stricter.

- BNP Paribas Fortis

- Website: www.bnpparibasfortis.be

- Head Office Address: Montagne du Parc 3, 1000 Brussels, Belgium

- Mortgage Conditions: Fixed rates 3–3.5% (10–30 years), down payment 10–20% for locals, 20–30% for non-residents. Specializes in foreign clients, offers green mortgages with preferential rates (2.8–3%) for energy-efficient homes (EEM label). No reservation fee in the first year. Required documents: passport, income proof (local or foreign), credit history. Non-residents need notarized translations.

- Features: Multilingual support, user-friendly online calculator, integration with Easy Banking App for application management.

- ING Belgium

- Website: www.ing.be

- Head Office Address: Avenue Marnix 24, 1000 Brussels, Belgium

- Mortgage Conditions: Rates 3.1–3.5% (10–25 years), down payment 15–25% for immigrants, up to 30% for non-residents. Specializes in expats and international company employees. Required documents: passport, residency permit (for immigrants), income proof, tax return. Approval process: 2–8 weeks, longer for non-residents.

- Features: Digital ING Banking platform, fast application processing, support in English, French, Dutch.

- KBC Bank

- Website: www.kbc.be

- Head Office Address: Havenlaan 2, 1080 Brussels, Belgium

- Mortgage Conditions: Rates 3–3.4% (10–30 years), down payment 10–20% for locals, 15–30% for foreigners. Simplified procedures for EU citizens, stricter for non-residents. Required documents: passport, income proof, residency permit (if applicable), credit history. Approval: 2–6 weeks.

- Features: Expertise in cross-border loans, KBC Mobile app for management, focus on small and medium businesses.

In conclusion, mortgages in Belgium make property purchase accessible, but foreigners should consult a real estate agent to minimize risks and choose the right bank. The choice between BNP, ING, or KBC depends on your status, budget, and language preferences.

Documents and Legal Aspects

Buying property in Belgium requires thorough document preparation and understanding of legal details to ensure a lawful and risk-free deal. The process is the same for locals, immigrants, and non-residents, but foreigners may face additional document requirements. The notary plays a key role, verifying documents, finalizing the deal, and ensuring property registration.

Here are the documents needed, where to obtain them, and associated costs:

- Passport or ID

- For Whom: All (locals, immigrants, non-residents).

- Where to Obtain: Locals — Belgian ID; foreigners — valid passport, sometimes with notarized translation via a sworn translator (list at lijst van beëdigd vertalers).

- Cost: Free if passport is valid; translation — €50–150 per document.

- Notes: Notary requires original or notarized copy.

- Proof of Income

- For Whom: All, if taking a mortgage; mandatory for non-residents.

- Where to Obtain: Employment certificate, tax return, or bank statements for 6–12 months. Non-residents need notarized translations via a sworn translator.

- Cost: Free (from employer/bank); translation — €50–200.

- Notes: Banks may request additional proof of stable income.

- Credit History

- For Whom: All, for mortgages.

- Where to Obtain: Locals — via Centrale des Crédits aux Particuliers (NBB); foreigners — bank certificate from home country with notarized translation.

- Cost: NBB request — free; translation — €50–100.

- Notes: Non-residents face challenges without Belgian credit history.

- Residency Permit (for immigrants)

- For Whom: Only immigrants with residency; not needed for locals or non-residents.

- Where to Obtain: Issued by local commune (gemeente/commune).

- Cost: €20–50 for issuance/renewal (varies by commune).

- Notes: Residency permit doesn’t affect purchase rights but aids mortgage applications.

Legal Aspects

- Notary’s Role: The notary verifies purchase documents, checks the property’s history (debts, liens), prepares the compromis and final deed, and registers the property in the cadastre. Cost: 0.2–4% of the house price (average 1.6%) + €813 for the deed + €596–813 for a mortgage. English-speaking support is available for foreigners.

- Home Inspection: Before signing the compromis, a certified expert inspection (€200–500 + VAT) is recommended to detect issues (e.g., dampness, wiring), especially in older homes.

- Pre-emption Rights: In some cases (often in Wallonia), the municipality or tenants can buy the property at your offered price. The notary checks this beforehand.

- Insurance: Mandatory for mortgages: building insurance (€200–500/year) and loan balance insurance (0.5–1% of loan). Optional household insurance (€100–200/year) covers contents.

Buying property in Belgium is a transparent process, but foreigners should prepare translated documents and account for the notary’s role. Checking the house and pre-emption rights reduces risks, and working with an experienced notary simplifies the deal.

Tip:

Choose a notary who speaks your language to avoid misunderstandings during property registration.

FAQ: Frequently Asked Questions About Buying a House in Belgium

Buying property in Belgium raises many questions, especially for newcomers. Here are answers to 10 common questions to help navigate the process, avoid mistakes, and understand market specifics for locals, immigrants, and non-residents. These tips complement earlier sections, focusing on practical nuances.

- Can I buy a house in Belgium without visiting the country?

Yes, non-residents can buy remotely, but you’ll need a trusted representative (real estate agent or notary) to sign documents. Use online platforms (Immoweb, Zimmo) and hire a lawyer to verify the deal. - How do I choose between buying a house or an apartment?

Houses in Flanders or Wallonia suit families and long-term investments (3–5% rental yield), while Brussels apartments are ideal for expats wanting proximity to work. Consider budget and maintenance costs (houses are pricier). - Is it worth buying a house at an auction?

Auctions (public or notarial) offer prices 10–20% below market rates but require quick decisions and a 10% deposit on the day of bidding. Inspect the property beforehand, as withdrawing after winning is impossible. - How does buying property affect taxes in my home country?

Non-residents pay Belgian tax on rental income (25–50% of profit). Check with a tax consultant if your country has a double taxation agreement with Belgium. - Can I rent out the house immediately after purchase?

Yes, there are no restrictions, but you must register the lease with the local commune (~€50). Foreigners need to declare rental income in Belgium. - How can I protect myself from fraud when buying?

Work only with licensed agents (CIB Vlaanderen members) and notaries (via be). Avoid private deals without verifying property history. - What is an Energy Performance Certificate (EPC), and why is it needed?

The EPC, mandatory for sales, shows a house’s energy consumption (A–G). Choose A–C rated homes to reduce utility costs and qualify for tax incentives. - Can I buy a house for commercial purposes?

Yes, commercial properties (offices, shops) are available, but VAT (21%) is higher than for residential properties. Check zoning (urbanism rules) via the commune before buying. - How long does the purchase process take without a mortgage?

With self-financing, the deal takes 1–3 months: 1–2 weeks for search, 1–2 months for notarial processing. Auctions can be faster (1 month). - Does buying a house affect visa or citizenship eligibility?

Property ownership doesn’t grant automatic visas or citizenship but strengthens residency applications (via investment or work) and simplifies naturalization after 5 years of residence.